Role

Industry

Solutions

Products

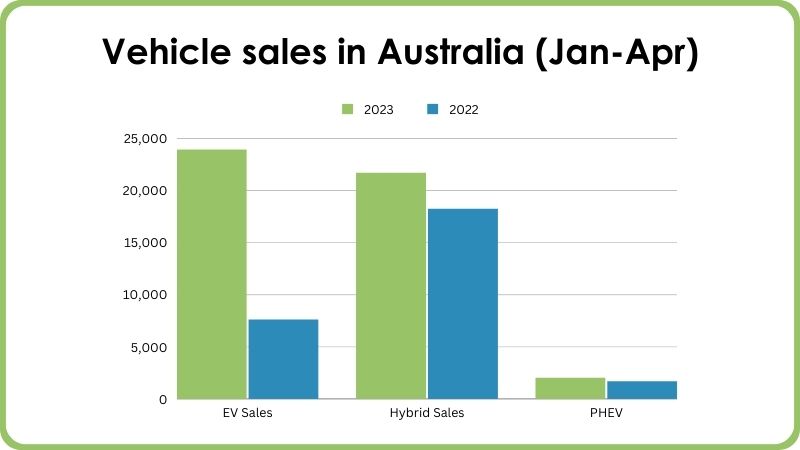

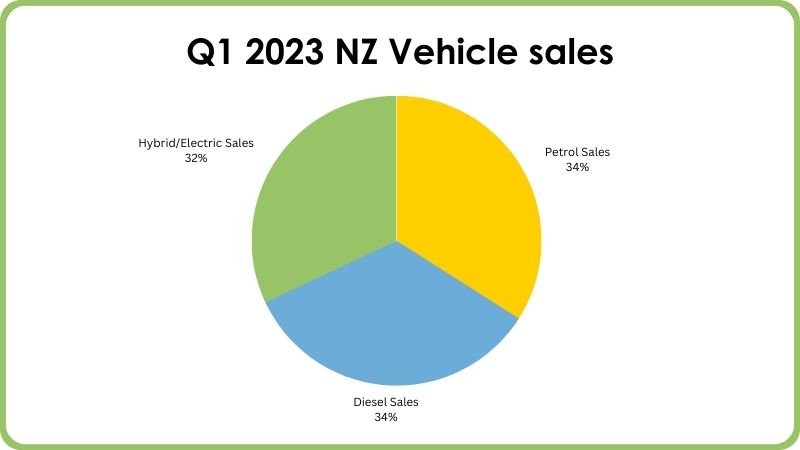

EV and hybrid sales are increasing on both sides of the Tasman. In NZ, 32% of all car sales so far in 2023 have been either electric or hybrid. In Australia, EV registrations hit a record of 8,124 during May and are outselling petrol-driven cars in the ‘Medium’ category.

While these stats are not specific to commercial fleets, there’s good news for fleet managers in these figures for three reasons.

These are all important indicators for fleet purchasing decision makers and as 2023 has seen significant sales growth for EVs we felt a wrap-up at the year’s midpoint would be worthwhile.

A range of factors are responsible for this growth. The journey distance available with modern EVs will be a factor for many; one of the top selling EVs on both sides of the ditch, the Tesla Model 3, has an estimated range of 602 km. There’s also more choice available in the EV segment with 60 models to choose from in Australia, although that’s still pretty meagre when compared to the around 230 models available in the EU.

This all looks quite rosy for the private purchaser segment but applying a commercial-fleet filter tells a different story. A range comparison with models more likely to be included in fleets, Hyundai IONIQ (300 kms) and Hyundai Kona (260kms with a battery upgrade), highlights how expanding range is pretty much limited to top of the range. There also isn’t a lot to celebrate on model choice either, as most fleets have restricted EV adoption to run-abouts and continue to shun the limited ute and 4-wheel drive offerings.

The advances in EV technology and choice are signalling that the automobile industry has come to the party, but the generator for that change has undoubtedly been government action. Legislatures in the EU and US have been aggressively pushing an EV agenda for some time and manufacturers have responded to that. In this part of the world, governments have been a bit slower, but government orchestrated change is definitely making itself felt now. NZ’s Clean Car Discount is now an established part of the vehicle purchasing landscape and Australia is making positive progress to adopting a Fuel Efficiency Standard. This legislation looks like having cross party support and will be presented to Parliament before the end of the year with the intention of coming into law during early 2024.

Australia is one of the few developed nations not to have fuel efficiency standards, so bringing them in is reason to celebrate although there are some caveats. Government messaging talks about “continued sales of the vehicles Australians love, including utes and 4-wheel drives”, so it looks like the big emitters will be getting some sort of pass when the legislation does come in. There’s obviously an element of realpolitik here; utes occupied the top three slots in vehicle sales during March this year and there wasn’t a single passenger sedan in the top ten.

To give that ranking some context, consider that on average Aussie passenger cars emit a massive 40% more carbon than the EU, and 15% more than New Zealand. This is because there are currently no requirements placed on vehicle importers to deliver cleaner operating vehicles to Australia. The Fuel Efficiency Standard addresses this and is probably helping to generate positive noise around EV ownership, but does it go far enough? The Federal Chamber of Automotive Industries (FCAI) Chief Executive, Tony Weber, thinks not, declaring that tighter “but achievable” fuel efficiency standards were needed to accelerate the shift to EVs. He also shared his thoughts about the cost of EVs, saying: “This growth [in EVs] demonstrates that where Australians can afford a battery electric vehicle which suits their lifestyle, they will buy them.” We are sure there are fleet managers who will agree with him. Evidence does seem to illustrate that many fleet managers see the cost of EVs as prohibitive, even if the savings in running costs and moving away from fossil fuels do bring down the TCO.

To be realistic, the Aussie love affair with utes and 4-wheel drives isn’t going to change anytime soon, so it’s up to vehicle manufacturers to lift their game in these categories. Although a limited range of electric utes is now available, most consumers are waiting for vehicles with the performance and cachet to get over the fact that they’re electric. The Ford 150 Lightning fits the bill with range options beyond 500 km and 0-60 in just four seconds, but it’s only a ‘maybe’ available next year. If you’re waiting for the Rivian R1T or Ram 1500 REV, the timescales are similar.

Until then, in ANZ, options include the LDV eT60 double-cab with just over 300km of range, although at full towing weight of 1,500kg that range drops to half. Robert Pepper does a great breakdown of towing dynamics and why EVs are a good match from a mass perspective, even if the range impact EVs face from drag are felt more acutely.

But on this point, Fleet Managers really have to ask themselves if range compromises when towing are actually a problem. Putting aside legitimate concerns about ‘outback journeys’, many ute trips are in reality taken by tradies around town. Smartrak is often asking organisations to be guided by the data rather than supposition and where this advice is followed fleets invariably discover that an EV is more than equal to the task. That said, the EV adoption success stories we have played a role in are invariably around passenger cars, with fleet managers echoing the sentiment of private buyers in considering the current crop of electric utes and 4-wheel drives unable to fit the bill.

Another shift that has come through in this year’s Australian figures that could be reflected in fleet purchasing decisions concerns hybrids. Sales of battery electric vehicles have overtaken hybrid cars for the second month in a row, with EVs now leading hybrids on a year-to-date basis for the first time. This is probably a reflection of improvements in EV tech and the growth of charging infrastructure, both of which make the decision to buy a hybrid ‘just in case’ less compelling. It will be interesting to see how this plays out, for us as well as our customers. Smartrak recently released a fleet solution that helps drivers book an EV with confidence by detailing battery level and anticipated range on that charge; we included hybrids in that solution because they are represented in the fleets we help manage and we thought are likely to remain so – just in case.

To wrap-up, let’s return to the topic of legislation. Leading fleet management company, FleetPartners, states that 17% of new business during the first half of 2023 involved orders for EVs. However, if we focus just on the stats for New Zealand, which has a more mature legislative environment for EV adoption, we see that half the order pipeline is for EVs. This is more than evidence of building momentum; it could be argued that the tipping point for more sustainable fleets has already been reached in some markets and legislation was generator of that change.